GENERAL INFO

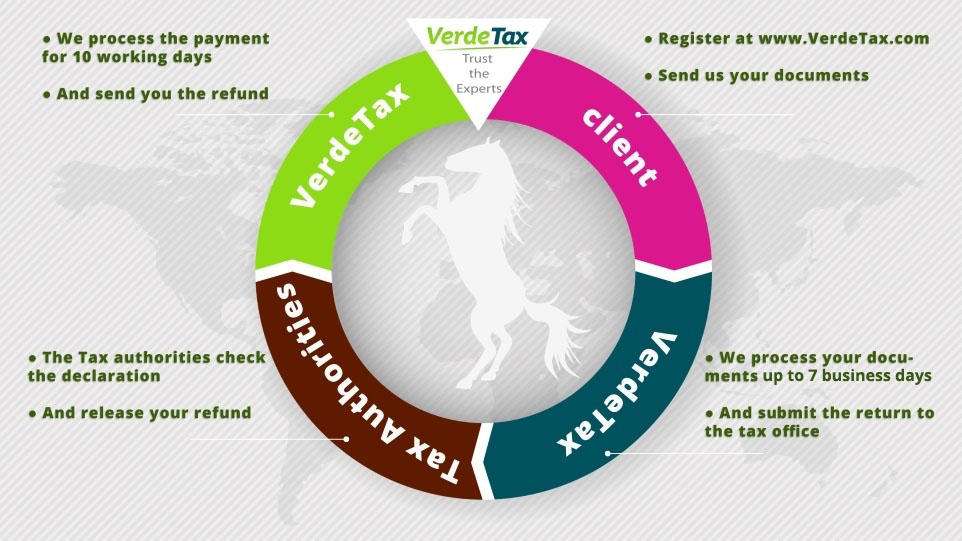

You have worked in the Netherlands during the last five years? In this case you have paid taxes and most likely you have overpaid taxes. We are here to help you get back your money!

If you were employed in the Netherlands, you have paid income tax and more specifically you have paid taxes on your wages. This tax had been withheld by your employer together with your social insurances. Depending on different factors and different conditions it is possible that you have paid too much tax, resulting in tax refund of the overpaid amounts, without even knowing.